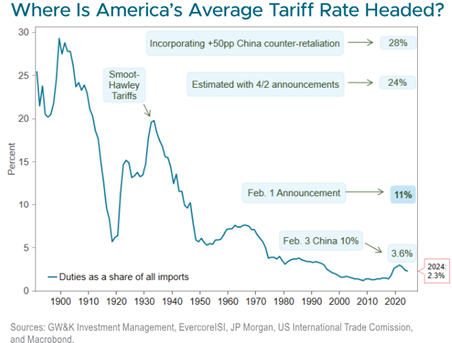

On April 2, 2025, President Donald Trump unveiled a sweeping trade policy that shocked global markets, calling it “Liberation Day”. The administration implemented a minimum 10% tariff on all U.S. imports, with additional “reciprocal” tariffs ranging from 10% to 49% depending on the country. China tariffs were increased dramatically, peaking at 145% after a series of tit for tat retaliations. The new tariffs were the highest in over a century,(refer to the exhibit) aimed to address the U.S.’s persistent trade deficit and to incentivize domestic manufacturing. However, the policy triggered immediate market volatility, reshaped corporate strategies, and set the stage for ongoing trade negotiations, with ripple effects still unfolding as of August 2025.

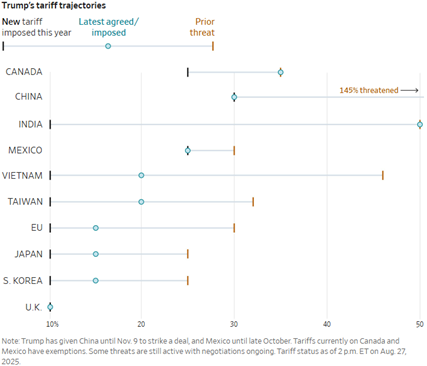

The announcement sent shockwaves through financial markets. The S&P 500 plummeted 12% in just four days, marking one of the worst selloffs in recent memory. Multinational companies like Nike and Apple saw shares drop around 7%, while discount retailers, such as Five Below and Dollar Tree, faced declines of 15% and 11%, respectively. The panic was driven by potentially disrupted supply chains and rising prices. On April 9, just as higher reciprocal tariffs were set to take effect, President Trump announced a 90 day pause to give extra time for negotiations. Markets reacted quickly with the S&P 500 rallying 9.5% in a single day, the largest daily gain since 2008. The rally reflected relief that the most punitive tariffs, particularly the 145% levy on Chinese imports, were temporarily on pause, and could be potentially negotiated lower. Since then, the tariff landscape has remained fluid, with multiple extensions of the deadline, and country specific negotiations leading to agreements with nations like the UK, Japan, and the EU. Most recently, the tariff truce with China was extended once again, to November 10, 2025, avoiding the higher tariffs on Chinese goods.

Despite the initial turmoil, markets have shown resilience. The S&P 500 has climbed 10.8% year to date, reaching new all time highs this summer. Corporate earnings have also exceeded expectations, as companies have been able to mitigate some of the tariff impacts through supply chain optimization. This adaptability, coupled with domestic economic growth, has helped stabilize investor confidence, though uncertainties linger as trade negotiations continue. It appears most of the tariff impacts will be felt in 3rd quarter earnings reports.

The tariffs’ economic effects have been mixed but less severe than initially feared. Globally, the tariffs have dampened economic growth forecasts. The IMF and OECD downgraded their 2025 global growth projections, citing trade disruptions. China’s GDP growth is expected to slow, with Goldman Sachs estimating a potential 2% drag from U.S. tariffs. The EU anticipates a small GDP contraction. In anticipation of the April tariffs, companies stockpiled inventory and front loaded purchases, leading to a rush of imports that contributed to a 0.5% decline in U.S. GDP in the first quarter of 2025. However domestic economy maintained its late 2024 growth trajectory. Second quarter GDP growth was revised upward to 3.3%.

Inflation has seen only a modest uptick so far, rising 2.7% year over year by June 2025, with tariffs contributing to higher prices for furniture, appliances, clothing, and commodities like coffee. Despite these concerns, consumer behavior has not shifted significantly, as price increases have been gradual. Retailers like Walmart have committed to keeping prices as low as they can for as long as they can with the CEO noting that inventory restocking costs are rising “a little each week” but have not yet disrupted purchasing patterns.

Companies have responded to the tariffs with mitigation efforts such as optimizing supply chains to reduce costs. Defense contractor, Raytheon, for example, initially projected an $800 million tariff impact but reduced this to $500 million in the latest quarter by diversifying suppliers and streamlining logistics. Other firms have followed suit, seeking alternative sourcing from countries like Vietnam or Thailand to bypass high tariffs on Chinese goods. This mirrors patterns observed during the 2017 2019 trade war, when Chinese exports were rerouted through Southeast Asian hubs to evade U.S. levies.

Retailers have also taken proactive measures. Walmart’s strategy of absorbing costs has helped maintain consumer demand, while other companies have negotiated lower prices with foreign suppliers or passed on modest price increases to customers. The exemption of certain goods, such as semiconductors and pharmaceuticals has provided relief to the tech and healthcare sectors. However, recent threats of imposing tariffs on these industries show the ongoing risks. For instance, a proposed 100% tariff on computer chips will raise costs for electronics and appliances but companies producing chips domestically would be spared.

The U.S. and China trade relationship remains the epicenter of the tariff saga. After escalating to 145% in early April, U.S. tariffs on Chinese imports were reduced to 30% and with China lowering its retaliatory tariffs to 10%. A failure to extend the tariff truce could reignite market volatility and further strain global supply chains. J.P. Morgan estimates the current effective tariff rate at 15.8%, with China facing the steepest levies at 30% (down from a potential 145%). Other countries, like India, now face a 50% tariff, complicating negotiations. The Budget Lab at Yale projects that the 2025 tariffs could reduce U.S. GDP by 0.6% in the long run equivalent to $160 billion annually.

On Friday August 29 the US Court of Appeals ruled 7-4 the President does not have the authority to impose tariffs using the International Emergency Economic Powers Act and stated only Congress has the authority to do so. The Court also ordered all tariffs already paid, to be refunded to importers. The decision is currently on hold as the administration seeks a Supreme Court ruling and if the case is accepted, hearings will likely be held in early November. If the decision is upheld by the Supreme Court, it will upend several trade agreements already negotiated and impact other framework deals currently being discussed.

For businesses, flexibility is key. Executives must navigate a landscape of shifting tariffs and geopolitical tensions, balancing cost mitigation with long term planning. Consumers, while insulated so far, may face higher prices if tariffs escalate further. For policymakers, the challenge is to balance Trump’s “America First” agenda with the risks of a global trade war that could undermine economic stability. As trade talks continue, the world watches to see whether “Liberation Day” will usher in a new era of U.S. economic dominance or a prolonged period of global uncertainty.

Andrew Otten,

Associate Portfolio Manager