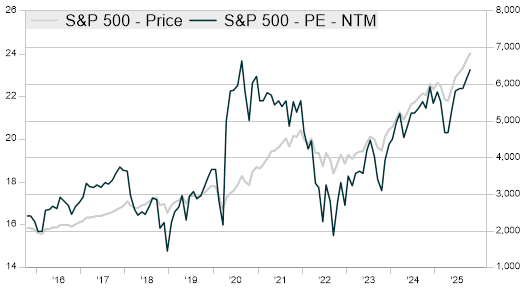

High starting valuations are generally associated with lower long-term forward returns. Although valuation metrics are weak short-term return predictors, history tells us that market returns using a 5-10 year horizon are likely to be impacted by elevated beginning valuations. Given the on-going rally and resulting valuations, investors should consider what this means for returns going forward and plan accordingly when making financial projections. As 2025 comes to a close, many analysts’ framework for future returns have seen downward revisions after strong recent gains.

Valuation as a Predictor of Short-Term Returns

Short-term returns tend to be noisy as market action is dominated by investor sentiment, economic surprises, and policy change. In fact, returns on a 1-year basis show little correlation with valuation metrics. This means that as investors, valuations should not be used as a timing tool- markets can deliver strong gains in the following 6-12 months even at elevated beginning valuations.

2025 serves as a perfect example: the S&P 500 entered the year with a Forward 12 Months Price/Earnings multiple of 21.7x, compared to a 10-year average of about 18.0x. Still, buoyed by optimism around Artificial Intelligence and the Fed easing rates, the S&P is +18.4% year-to-date.

Valuation as a Predictor of Long-Term Returns

Long-term returns, however, drift toward fundamentals. As horizon takes a longer lens, returns become a function of corporate earnings growth and return of capital to shareholders combined with a plausible change in the Price/Earnings multiple. So where does that leave us today?

Earnings growth has been strong in 2025 and estimates call for about 14% year-over-year growth in 2026 for the S&P 500. Importantly, in 2026 analysts are projecting revenue growth of 6.6% with the remainder of earnings growth coming from margin expansion.

But investors should heed caution that there is little cushion for forward returns from valuation alone in the form of multiple expansion. At the current Forward 12 Months Price/Earnings multiple of 23.3x, the S&P 500 trades at a 25% premium to the 10-year average. In other terms, returns in the long-term must be supported by return of capital to shareholders (share buybacks or dividend growth) and from corporate earnings growth. If substantial positive returns from current levels are driven by multiple expansion, markets will show signs of a bubble and likely experience a correction. Ultimately, the plausible change in the Price/Earnings multiple should be considered flat or lower from current levels in the long-term.

Takeaway for Clients

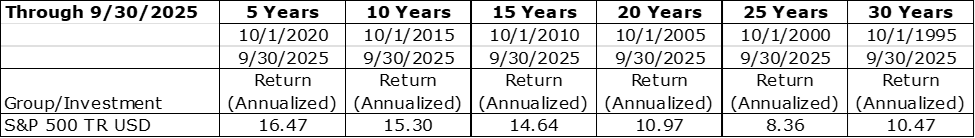

The top consideration should be caution and conservatism when setting multi-year return assumptions. Any stress testing or scenario analysis should consider cases of more modest equity returns in the coming decade than have been experienced in the prior decade.

This is not to say expectations for a 10-year return for equities is zero or negative, but there is a real possibility of returning to more normal long-term rates of compounding. The last decade has seen annualized returns of 15.3% compared to a 25 year return of 8.4%.

When thinking about returns for the next 10 years compared to the last 10 it’s worthwhile to consider that a large portion of the outsized returns from the last decade are from the Magnificent 7. In the last 10 years, the S&P 500 has gone from a total market capitalization of $18.3 trillion to $57.0 trillion through 9/30/25. In that same period, the Magnificent 7 has added $20 trillion of market capitalization. Nvidia alone added $5 trillion of market cap in the last decade.

Without the performance of the Magnificent 7, returns of the last decade begin to look more ordinary and in-line with long-run data rather than the extraordinary figures above. It’s important because the earnings growth and multiple expansion that occurred will be hard to replicate going forward.

Sources: FactSet, Morningstar Direct

Greg Barshied, CFA

Portfolio Manager