There are many important decisions you will need to make during your transition into retirement. Few of them will have a greater impact on success than determining the cost of your desired lifestyle and how it will change. Planning for this on a deeper level mitigates the risk of spending down assets too quickly. Circumstances change and undoubtedly there are expenses which cannot entirely be accounted for. Spending shocks like inflation, taxes, increasing healthcare costs and long-term care can decimate a retirement portfolio, and planning for these expenses will be addressed in future communication. Today, however, the focus will be on how to develop a deliberate approach to estimating your retirement spending under normal circumstances.

A common “rule of thumb”

It is hard to read anything about retirement planning without seeing a reference to the “rule of thumb” that a comfortable retirement lifestyle will cost somewhere between 55% and 80% of your pre-retirement earnings (Income Replacement Ratio or IRR). Most studies have shown that an IRR of 70% to 80% is a reasonable estimate for most people, while 55% is possible for those transitioning from more lucrative careers. Using the income replacement ratio to estimate your retirement expenses certainly can be a good starting point for determining retirement readiness. However, you should be careful to think about your individual plans and circumstances, and how they will impact your anticipated cash needs as you progress through your retirement. For instance:

You may be planning to retire early and spend the first few years “catching up” on the many experiences you put off while working. This may require you to plan for a much higher income replacement ratio in your early years. Or you may be planning for a very simple retirement that allows you to take advantage of the rest you craved while working. Neither of these situations would be fully consistent with a constant income replacement ratio and could lead you to retire too early, or potentially, later than you can.

A more” scientific” Approach

You may be able to achieve a more accurate estimate of your retirement needs by itemizing your current expenses and adjusting each one for anticipated changes. Although this takes more energy and can feel like the budgeting process many have avoided during their lifetime, you may find that it brings important insights into what you will really need. We routinely find that expending the effort to be more precise provides clarity and comfort at an overwhelming time. If itemizing each of your expenses is just too daunting, you may want to consider the middle ground of grouping them into major categories like housing, food, clothing, entertainment, healthcare, transportation, and others, then adjust those broad categories for your circumstances. This approach may feel more manageable, while still providing a reliable result.

Expenses Will Change Over Time

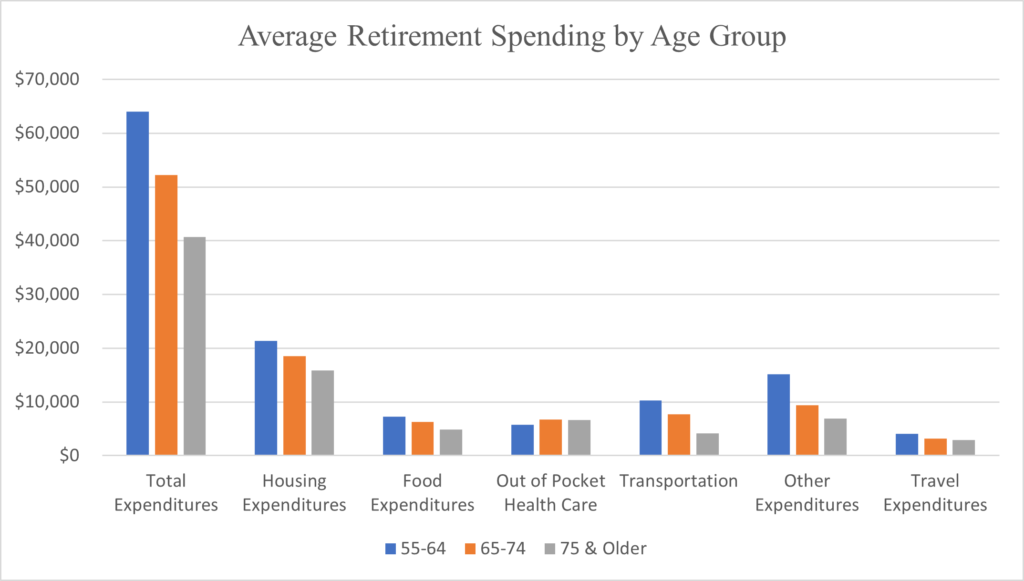

Whichever method you choose to estimate your initial retirement expenses, it is important to note that your overall spending will probably go down as you age. A 2020 study by the Social Security Administration showed that average overall spending by retirees decreased by at least 20% between the early and late stages of retirement. Assuming you are like most others, time will take its toll on your energy and corresponding desire to remain as active as you once were. Therefore, your overall lifestyle expenses will “step-down” significantly as you age. You will spend less on things like housing, entertainment, transportation, food, travel, and clothing. This phenomenon is captured by the graph below, which summarizes expense patterns for the “typical” retiree.

Source: Social Security Administration – “Expenditures of the Aged Chartbook 2020”

There are various ways to estimate your retirement expenses, each of which can be effective in the right situation. No matter how you approach estimating them, it is critical that you consider your own circumstances and how your expenses may change between your working years, early, and late retirement. Of course, we have ignored the impact of spending shocks in this article. Planning for these expenses will be the topic of future communications. For now, take the time to employ a thoughtful process that considers your unique situation. This will inspire confidence and decrease the likelihood of running out of money at the worst possible time. In the meantime, please do not hesitate to contact your Legacy Trust Advisor about this or any other retirement planning topic. Our experts are here to help you achieve the retirement you have worked so hard for your entire life!

Brian Moore, MBA, CFP®, CTFA®

Senior Wealth Advisor

Collin Hartley

Associate Wealth Planner