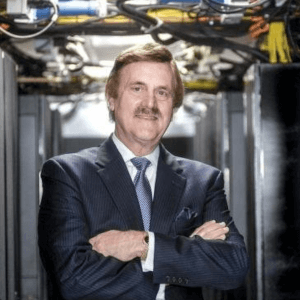

Grand Rapids, Mich. (September 12, 2023) – Legacy Trust, the largest private trust bank headquartered in Grand Rapids, is pleased to announce the appointment of Larry Andrus to its Board of Directors. Mr. Andrus brings more than 50 years of professional sales, leadership and business ownership to this new role.

Mr. Andrus’ professional experience includes owning and leading Andrus Advisors, LLC, a business, personal and nonprofit consulting and mentorship firm in Grand Rapids, as well as the Trivalent Group also based in Grand Rapids, which he sold to Rehmann in 2018. His other professional work includes 15 years in the high-end technology leasing industry, serving as Vice President of the Central Region for AT&T Capital. He started his career with the Burroughs Corporation working in sales, sales management, Great Lakes District product management and serving as one of the youngest branch managers in the country.

“Larry is a terrific business and community leader and we are very pleased to have him join our Board,” said Tracey Hornbeck, president and CEO of Legacy Trust. “He brings a wealth of wisdom and experience, as well as a tremendous passion for our community. We’re fortunate to have him join our organization.”

In addition to his professional accomplishments, Mr. Andrus is a dedicated civic leader, lending his time and talents to many nonprofit organizations. He served as President of the Grand Rapids Jaycees and Foundation, and Chair of the Better Business Bureau of Western Michigan. He was also on the Board of the Comprehensive Therapy Center, a member of the Advisory Board of the Autism Support of Kent County, and served on the campaign cabinet for Make-A-Wish of Michigan. Passionate about education, Mr. Andrus has also served as a member of the Board of Trustees for Alma College and received the Distinguished Alumni Award from the college in 2020. He has also given his time to the Catholic Schools in Grand Rapids.

“Legacy Trust is an elite financial institution in West Michigan and I am proud to join their Board of Directors,” said Mr. Andrus. “As a locally-based investment management, trust services and wealth planning firm, the advisors and leadership are focused on the specific needs of their clients. It’s that personal service and overall excellence that sets them apart from other companies in the industry.”

Legacy Trust is an independent, locally owned, Michigan-chartered bank that was founded in 2004. Its staff specializes in providing wealth management, planning and trust services to individuals, families, foundations and nonprofits in the region. It has been recognized multiple times as one of the Best and Brightest Companies to Work for in West Michigan.

“Larry is a dynamic leader, advisor, business owner, civic leader and philanthropic supporter in our community – someone who has achieved great things over several decades,” said Legacy Trust Board Chair, Steve Heacock. “We are grateful to add his extensive business knowledge and insights to Legacy Trust.”

Mr. Andrus’ appointment to the Board was finalized on September 7, 2023.